does tennessee have inheritance tax

If the total Estate asset property cash etc is over 5430000 it is subject to the Federal Estate Tax Form 706. IT-13 - Inheritance Tax - Taxability of Property Located Inside or Outside the State Owned by Tennessee Resident IT-14 - Inheritance Tax - Taxability of Property Located Inside or Outside the State Owned by Non-Tennessee Resident IT-15 - Inheritance Tax Exemption for Non-Tennessee Resident IT-16 - No Beneficiary Classes for Inheritance Tax.

Tennessee Inheritance Laws What You Should Know Smartasset

Its paid by the estate and not the heirs although it could reduce the value of their inheritance.

. It simply does not exist any longer. The legislature set forth an exemption schedule for the tax with incremental increases for the exemptions until it is completely eliminated in 2016. Inheritance tax is imposed on the value of the decedents estate that exceeds the exemption amount applicable to the decedents year of death.

Until that time estate administrators must continue to file the appropriate returns and pay the required estate taxes if the estate is larger than the amount of the exemption. It is one of 38 states with no estate tax. Impose estate taxes and six impose inheritance taxes.

Tennessee is an inheritance tax and estate tax-free state. Under Tennessee law the tax kicked in if your estate all the property you own at your death had a total value of more than 5 million. It has no inheritance tax nor does it have a gift tax.

Technically Tennessee residents dont have to pay the inheritance tax. In 2012 the Tennessee General Assembly chose to phase out the states inheritance tax over a period of several years. However there are additional tax returns that heirs and survivors must resolve for their deceased family members.

Only seven states impose and inheritance tax. It is possible though for Tennessee residence to be subject to an inheritance tax in another state. Surviving spouses are always exempt.

There are NO Tennessee Inheritance Tax. Inheritance tax returns are usually due within one year and some states offer discounts for filing earlier. Additionally the Tennessee inheritance tax is now abolished in Tennessee for any person who dies in 2016 or later.

The inheritance tax applies to money and assets after distribution to a persons heirs. State inheritance tax rates range from 1 up to 16. An inheritance tax is a tax on the property you receive from the decedent.

There are NO Tennessee Inheritance Tax. Up to 25 cash back Tennessee Terminology What Tennessee called an inheritance tax was really a state estate tax that is a tax imposed only when the total value of an estate exceeds a certain value. Therefore the Tennessee income tax rate is 0.

In 2021 federal estate tax generally applies to assets over 117 million. According to the Tennessee Department of Revenue Inheritance tax is imposed on the value of the decedents estate that exceeds the exemption amount applicable to the decedents year of death The TN Department of Revenue goes on to explain. Tennessee does not have an inheritance tax either.

All inheritance are exempt in the State of Tennessee. Those who handle your estate following your death though do have some other tax returns to take care of such as. All inheritance are exempt in the State of Tennessee.

If the value of the gross estate is below the exemption allowed for the year of death an inheritance tax return is not required. Tennessee levies tax on other items outside of income. For the purposes of this post we are going to address the last question about Tennessees inheritance tax.

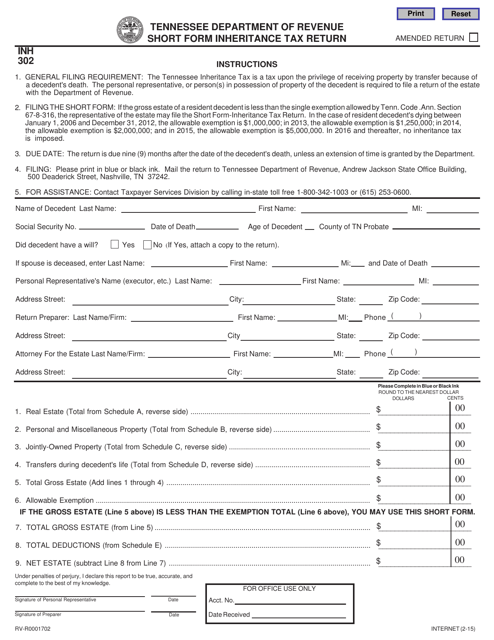

In 2015 the Tennessee estate tax applied to high value estates that were worth more than 5 million. Final individual federal and state income tax returns. The Tennessee Department of Revenue has two forms one for estates that are less than 1 million and one for estates that are greater than 1 million.

In addition to the federal estate tax with a top rate of 40 percent some states levy an additional estate or inheritance tax. In 2016 the inheritance tax will be completely repealed. This is how they collect money to pay for municipal items such as first responder services infrastructure roads schools and more.

Maryland is the only state to impose both. In 2012 Tennessee passed a law to phase out the estate or inheritance tax over time. Even though this is good news its not really that surprising.

Inheritance Tax in Tennessee. There is a chance though that another states inheritance tax will apply if you inherit something from someone who lives in that state. Federal estatetrust income tax return.

The inheritance tax is levied on an estate when a person passes away. All inheritance are exempt in the State of Tennessee. Most states have been moving away from estate or inheritance taxes or have raised their exemption levels as.

Under Tennessee law the inheritance tax was actually an estate tax a tax that was imposed on estates that were valued over a certain dollar amount. Inheritance tax usually applies when a deceased person lived or owned property in a state with inheritance tax. If you pass away in Tennessee with an estate less than 1 million there is no inheritance tax.

2 An estate tax is a tax on the value of the decedents property. The executor will determine which form is necessary and go from there. Each due by tax day of the year following the individuals death.

1 A capital gains tax is a tax on the proceeds that come from the sale of property you may have received. Also estates of nonresidents holding property in Tennessee must file an inheritance tax return INH 301. It means that even if you are a Tennessee resident but have an estate in Kentucky your.

So there are no separate considerations needed to handle any Tennessee inheritance tax. Tennessee does not have an estate tax. However it applies only to the estate physically located and transferred within the state between Tennessee residents.

It does have however a flat 1 to 2 tax rate that applies to income earned from interest and dividends. There is no federal inheritance tax but there is a federal estate tax. The net estate is the fair market value of all assets less any allowable deductions such as property passing to a surviving spouse debts and administrative expenses.

Tennessee Inheritance and Gift Tax. The inheritance tax is paid out of the estate by the executor. The inheritance tax is different from the estate tax.

If the total Estate asset property cash etc is over 5430000 it is subject to the Federal Estate Tax Form 706. Twelve states and Washington DC. However if the estate is undergoing probate a short form inheritance tax return INH 302 is required.

Tennessee is an inheritance tax-free state. For example the neighboring state of Kentucky does have an inheritance tax. Follow me on Twitter at jasonalee for updates from the Tennessee Wills and Estates blog.

Due by Tax Day of the year following.

Tennessee Retirement Tax Friendliness Smartasset

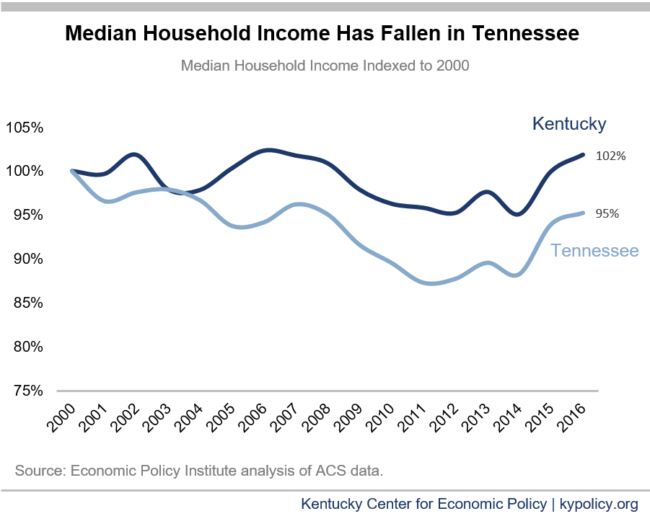

Shifting To A Tennessee Like Tax System Would Harm Kentucky Kentucky Center For Economic Policy

Tennessee Health Legal And End Of Life Resources Everplans

There Are Several Types Of Power Of Attorney To Consider When Planning Your Estate Contact An Experien In 2022 Estate Planning Attorney Legal Services Estate Planning

Tennessee Estate Tax Everything You Need To Know Smartasset

Divorce Laws In Tennessee 2022 Guide Survive Divorce

Tennessee Inheritance Laws What You Should Know Smartasset

Tennessee Estate Tax Everything You Need To Know Smartasset

Form Rv R0001702 Inh302 Download Fillable Pdf Or Fill Online State Inheritance Tax Return Short Form Tennessee Templateroller

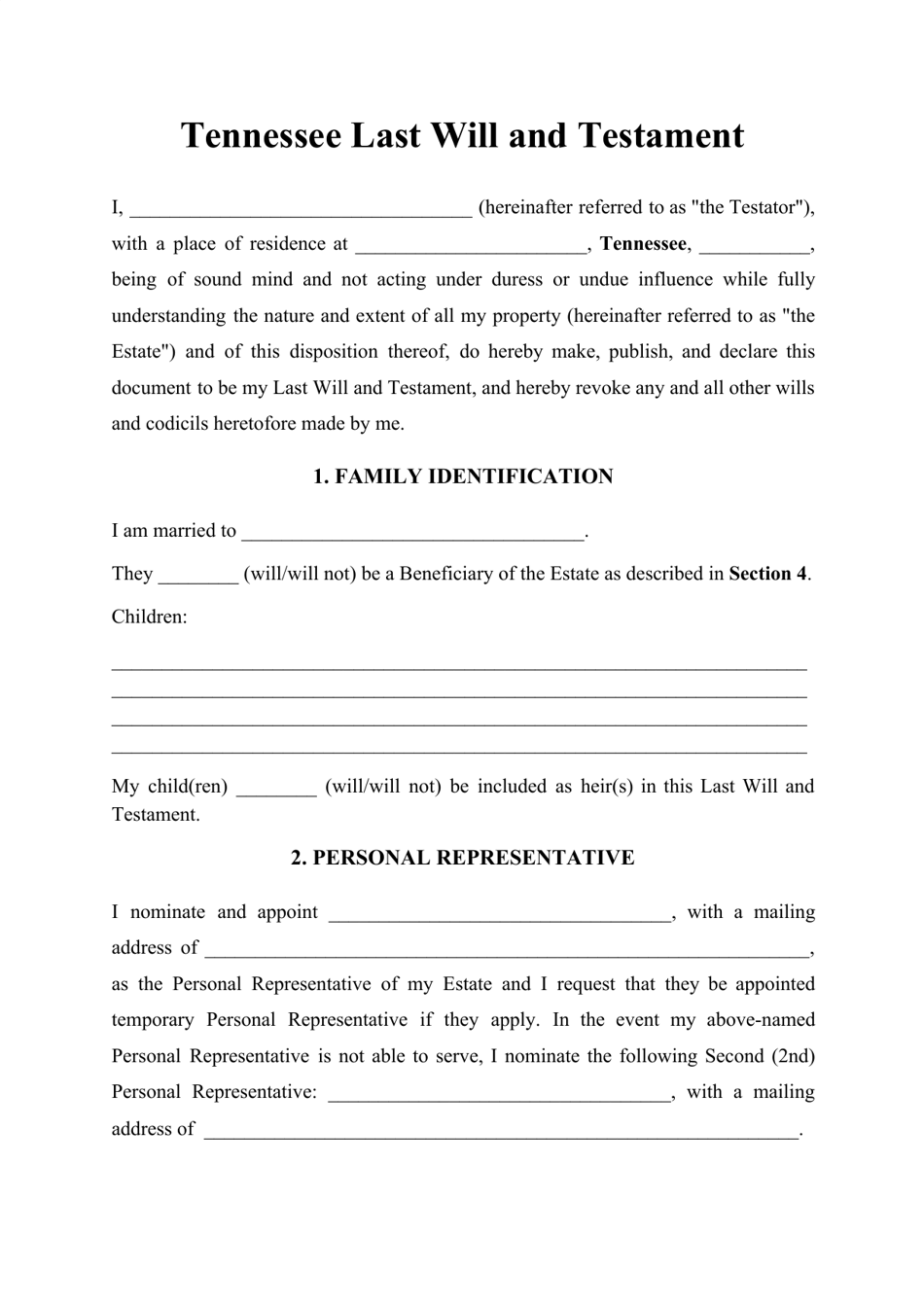

Tennessee Last Will And Testament Template Download Printable Pdf Templateroller

Historical Tennessee Tax Policy Information Ballotpedia

State By State Guide To Taxes On Retirees Tennessee Gas Tax Inheritance Tax Income Tax

Tennessee Estate Tax Everything You Need To Know Smartasset

Tennessee Retirement Tax Friendliness Smartasset Com Federal Income Tax Income Tax Return Inheritance Tax

The 35 Fastest Growing Cities In America City Houses In America Murfreesboro Tennessee

Where S My Tennessee State Tax Refund Taxact Blog

Do You Need A Tax Id Number When The Trust Grantor Dies Probate When Someone Dies Last Will And Testament